Culture

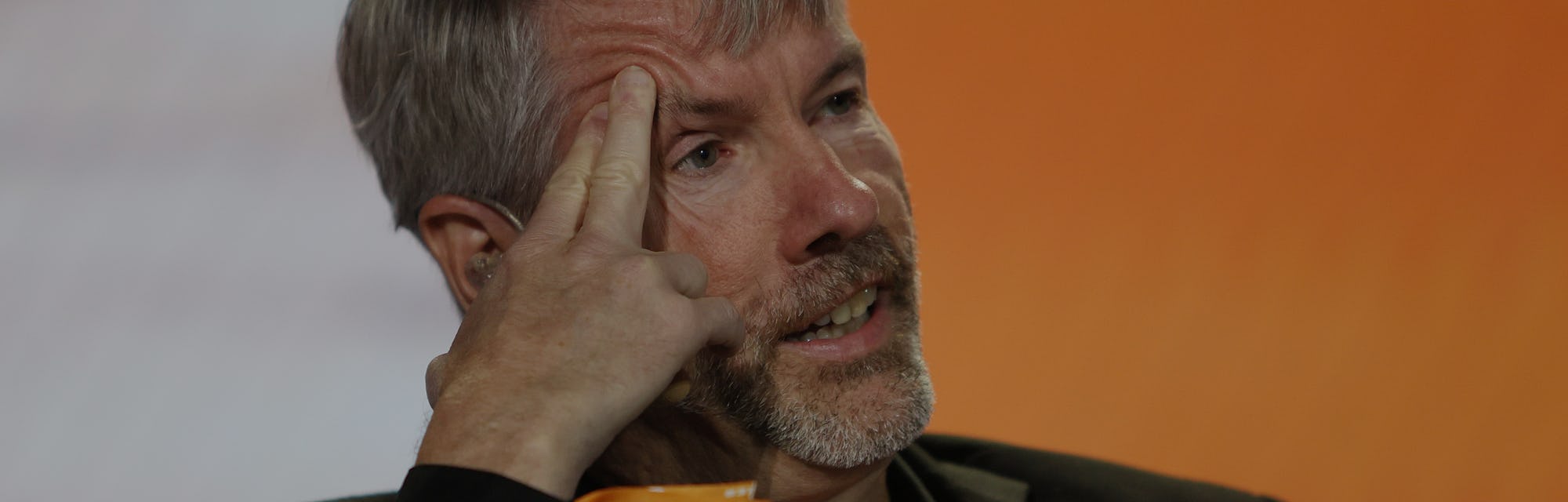

Crypto CEO steps down after bad Bitcoin bet to... focus on Bitcoin

Michael Saylor's transition within MicroStrategy comes after leaving a $918 million impairment charge in the company's books.

For anyone who isn’t invested in knowing the expansive cast of characters in crypto’s wild west, Micheal Saylor is probably a name that rings no bells. The Bitcoin maximalist, or “maxi” as it is commonly referred to, has decided to vacate his position as CEO of MicroStrategy, a company he founded in 1989, after leaving a $917.8 million impairment charge on its bitcoin holdings.

In other words, the company’s bitcoin reservations, the bulk of which were acquired over the last two years as an investment asset (under Saylor’s direction, of course), are now worth close to a billion dollars less than what they were purchased for.

Coindesk notes that MicroStrategy’s reserve of about 130,000 bitcoin is worth about $3 billion, but were purchased for close to $4 billion. The decision to buy up the digital currency was made in 2020 as one of the main tenets of the business intelligence company’s capital allocation strategy.

Tell us how you really feel — Back in August of that year, following an acquisition of close to 22,000 bitcoin for $250 million, Saylor noted that bitcoin “is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.”

It’s worth noting that these massive amounts of bitcoin holdings were being funded with MicroStrategy’s own cash, which it was borrowing by selling off stock (or debt if looked at another way). But with the crypto market in disarray, these digital assets are putting a strain on the company’s balance sheet.

After stepping down this week, Saylor has decided to leave Phong Le, formerly the president and chief financial officer (CFO), in charge of the business. Saylor will move into the role of executive chairman.

So is this a proverbial ride off into the sunset moment for Saylor? Or perhaps a teachable turn of events about leveraging your company’s assets to rely entirely on bitcoin’s future? Not exactly.

According to the aforementioned Coindesk article, Le noted during an earnings conference call that Saylor would re-direct his focus towards... you guessed: “Bitcoin strategy.”

A New York Times article published this week explored the dedication bitcoin maximalists have towards the currency and Saylor himself was included in the piece. His response to MicroStrategy’s $10 million purchase of 480 bitcoin during the height of the price crash — which was described as the smallest single purchase the company had made in over a year — reflects the unyielding faith among evangelists in Bitcoin’s value: “I always wish we could buy more... It’s frustrating,” he told the New York Times.